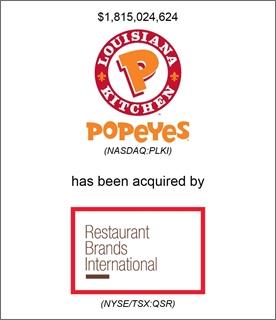

Genesis Capital is pleased to announce that Popeyes Louisiana Kitchen, Inc. (“Popeyes”) (NASDAQ: PLKI) has been acquired by Restaurant Brands International Inc. (“RBI”) (NYSE/TSX: QSR, TSX: QSP).

The acquisition of Popeyes will add a successful, highly-regarded brand with strong customer loyalty to RBI, one of the largest global quick service restaurant companies with two of the world’s most iconic QSR brands – BURGER KING® and TIM HORTONS®.

Founded in New Orleans in 1972, Popeyes has 45 years of history and culinary tradition and is the franchisor and operator of Popeyes® restaurants. Today, Popeyes is one of the world’s largest quick service restaurant chicken concepts with over 2,600 restaurants in the U.S. and 25 other countries around the world and its global footprint will complement RBI’s existing portfolio of over 20,000 restaurants in more than 100 countries and U.S. territories.

Daniel Schwartz, Chief Executive Officer of RBI, said, “Popeyes is a powerful brand with a rich Louisiana heritage that resonates with guests around the world. With this transaction, RBI is adding a brand that has a distinctive position within a compelling segment and strong U.S. and international prospects for growth. As Popeyes becomes part of the RBI family we believe we can deliver growth and opportunities for all of our stakeholders including our valued employees and franchisees. We look forward to taking an already very strong brand and accelerating its pace of growth and opening new restaurants in the U.S. and around the world.”

Cheryl Bachelder, Chief Executive Officer of Popeyes, said, “I am proud of the superior results the Popeyes team has delivered in recent years; they have served all stakeholders well. As Popeyes enters its 45th year, its success reflects the amazing brand entrusted to us by founder Al Copeland, Sr. and the unique high trust partnership that we enjoy with our franchise owners. RBI has observed our success and seen the opportunity for exceptional future unit growth in the U.S. and around the world. The result is a transaction that delivers immediate and certain value to the Popeyes shareholders.”

Popeyes received financial advice from Genesis Capital LLC and UBS and legal counsel from King & Spalding LLP. RBI was advised by Paul, Weiss, Rifkind, Wharton and Garrison LLP.

RBI Family of Brands

The BURGER KING® and TIM HORTONS® brands are owned by Restaurant Brands International Inc., one of the world’s largest quick service restaurant companies with more than $24 billion in system sales and over 20,000 restaurants. RBI has a proven track record of growing its iconic brands by driving continued system-wide sales growth and expanding its restaurant footprint, while maintaining its focus on delivering great guest satisfaction and strong profitability for its franchise owners.

Founded in 1954, the BURGER KING® brand is the second largest fast food hamburger chain in the world. The original HOME OF THE WHOPPER®, the BURGER KING® system operates more than 15,000 locations in more than 100 countries and U.S. territories. Almost 100 percent of BURGER KING® restaurants are owned and operated by independent franchisees, many of them family-owned operations that have been in business for decades.

TIM HORTONS® is one of North America’s largest restaurant chains operating in the quick service segment. Founded as a single location in Canada in 1964, TIM HORTONS® appeals to a broad range of consumer tastes, with a menu that includes premium coffee, hot and cold specialty drinks (including lattes, cappuccinos and espresso shots), specialty teas and fruit smoothies, fresh baked goods, grilled Panini and classic sandwiches, wraps, soups, prepared foods and other food products. As of December 31, 2016, TIM HORTONS® had more than 4,600 system wide restaurants located in Canada, the United States and the Middle East.